US Federal Reserve cuts key rates of interest for the primary time in 4 years

The US dollar stays the world’s most vital currency, and the American economy is arguably an important economic system. Therefore, when the US Federal Reserve makes a significant announcement, it sets off an economic wave that ripples all over the place. That’s why Wednesday’s decision to chop the federal funds rate by 0.50% is a really big deal.

Many speculated that the Federal Reserve would begin cutting rates of interest this week, however it was widely believed that it might begin a rate-cutting cycle with a 0.25% cut. The 50 basis point cut brings the benchmark rate of interest all the way down to 4.75% to five%.

The US Federal Reserve announced in a press release: “The Committee is more confident that inflation is moving sustainably towards 2% and concludes that the risks to the achievement of its employment and inflation objectives are broadly balanced.”

Federal Reserve Chairman Jerome Powell said: “We are trying to achieve a situation where we restore price stability without having the kind of painful rise in unemployment that sometimes accompanies this inflation. That is what we are trying to do and I think today’s action can be seen as a sign of our strong commitment to achieving that goal.”

Immediately after the news of the primary US rate of interest cut in 4 years, the main stock market indices reacted with a transient jump on Wednesday. However, they ended the day almost unchanged. This gave the impression to be a somewhat delayed response by investors, because on Thursday the bulls returned: the Nasdaq rose by 2.5 percent and the Dow jumped by 1.3 percent, exceeding the 42,000 point mark for the primary time.

In particular, former US President Donald J. Trump continued to criticise the monetary policy decisions of the US Federal Reserve. This despite Centuries of economic wisdom They tell us that it’s a foul idea for politicians to interfere in short-term monetary policy. (See: Türkiye – Erdogan, Tayyip.) In the Bitcoin bar PubKey on WednesdayTrump said: “Either the economy would be very bad or they would be playing politics.”

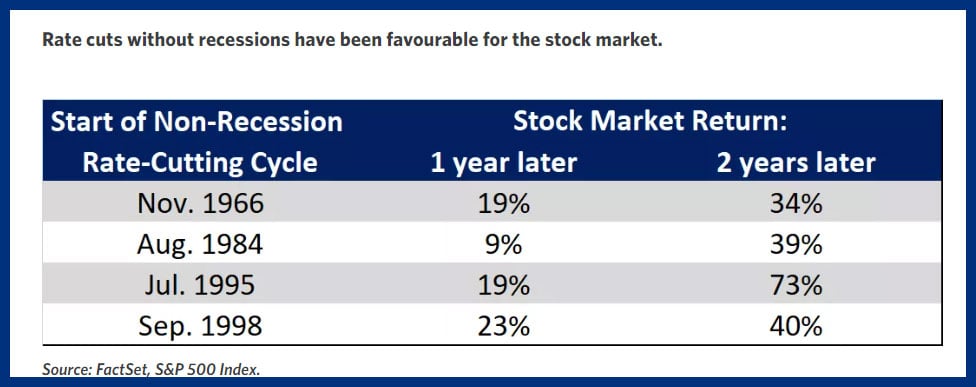

The stronger than expected rate of interest cut some commentators The query is whether or not this measure would spook the markets. But if the Fed can pull the string and cut rates of interest without causing a recession, it could possibly be thing. The historical precedents are very positive for shareholders.

This significant rate cut helps to ease the pressure on emerging markets which have borrowed in US dollars. And it eases the pressure on other central banks world wide that desired to avoid an excessive amount of depreciation of their currencies against the powerful US dollar.